For many college students, it’s difficult to think about saving for retirement. The primary financial goal of most students is to graduate college with the least amount of debt possible.

But in today’s economy, it’s ideal to start considering retirement sooner rather than later.

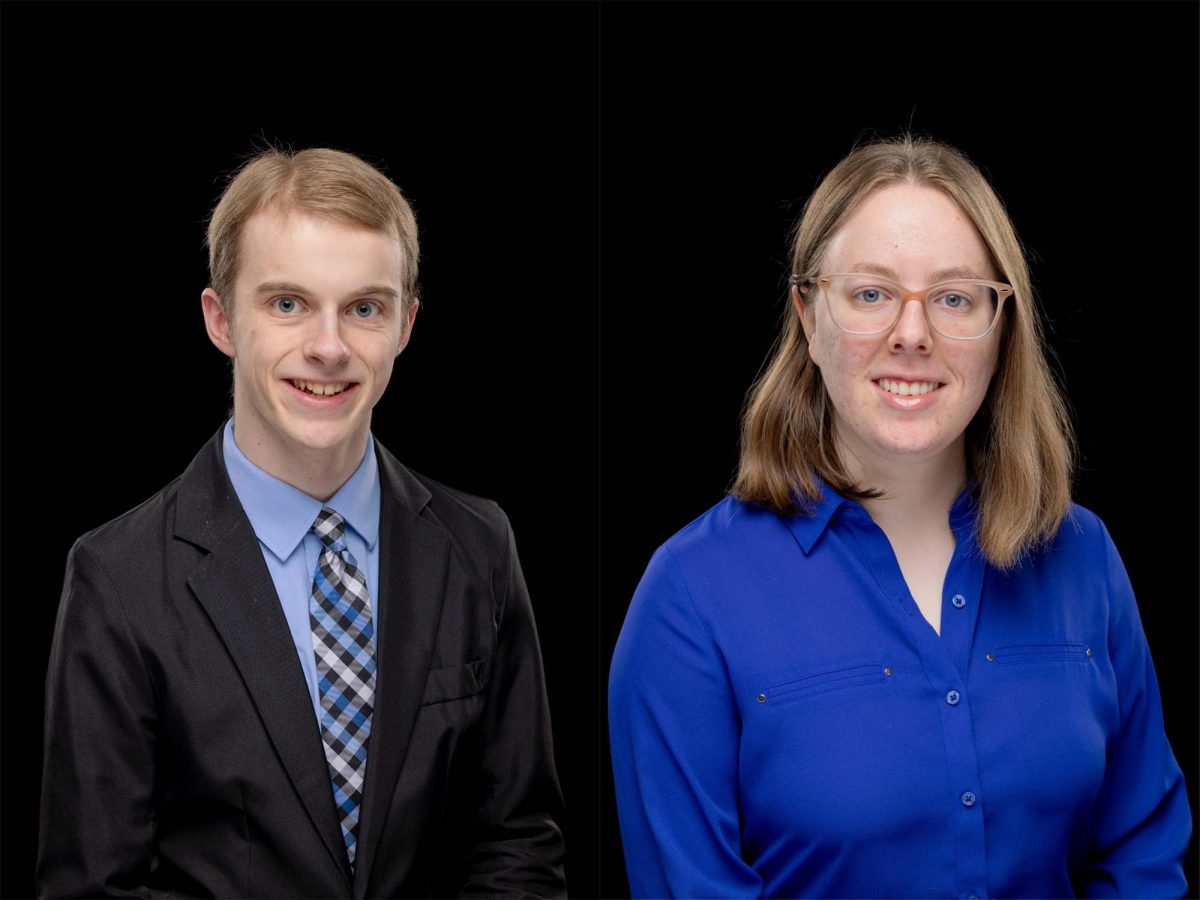

Bill Burkholder, a professor in BJU’s School of Business, is familiar with investments and savings since he spent several years as an investment adviser.

He said it’s important for students to understand and use the power of compounding interest.

Compounding interest refers to earning interest on interest you’ve been paid the previous year.

“I wish somebody had told me about [compounding interest] when I was 22,” Burkholder said.

His advice to college students is to start saving money now—even if it’s just a little bit at first.

“Do something to start putting money away while you’re young,” he said.

Clay Bryant, university host and senior business major, is already saving for retirement. Bryant says he pays himself. “I take the equivalent of one hour’s worth of wage, and I put that towards retirement.” Bryant rounds up his hourly wage and puts $10 into a long-term savings account every day.

Bryant also works a second job at Starbucks, and he said those funds go directly toward his school bill.

When making investments, Burkholder said it’s important to think long-term. Set aside a reasonable financial fund, but consider other expenses as well.

However, Burkholder warned against taking all extra money and putting it away for retirement.

“Lots of retirement money can’t be pulled out before retirement without a huge penalty,” he said.

That’s why it’s important to be frugal and consider storing money in other accounts, such as Dave Ramsey’s concept of an emergency fund.

Another helpful tip Burkholder offered involves asking about financial benefits when interviewing for a job.

“Most companies will match what you put in up to a certain percentage,” Burkholder said.

“Maximize that investment. Take advantage of that.”

Such benefits are necessary to consider when negotiating with a potential employer.

This is especially important for college students to consider since many are considering their first post-graduation job.

Overall, Burkholder said it’s extremely important for college students to get some kind of financial advice.

While retirement seems far away for most college students, it’s wise—and biblical—to consider the future.

And while Christian students should use their money wisely and be good stewards of what God has given them, it’s important to remember the concept of Matthew 6:19-21.

“Treasures in heaven” are of far greater value than anything this world offers.