“When I came here as president and I met with our cabinet in our first meeting, I made it very clear where I stood on the race issue,” President Steve Pettit said Wednesday, Feb. 15, during the 2017 Bible Conference.

“And so I decided at that time we were going to seek back our tax-exempt status because we don’t believe [the policies we once held]. That’s not what we believe.”

In meetings since he became president, Pettit told faculty, staff and alumni that regaining tax exemption was one of his top priorities.

His announcement from the stage of Founder’s Memorial Amphitorium was the first time students heard the official news. Shouts of support and extended applause followed.

Thirty-four years after the landmark Supreme Court decision to remove the University’s tax exemption due to its former interracial dating policy, over 200 publications covered the resolution of the story that drew national attention throughout the 1980s into the early 2000s.

Although the policy was rescinded nearly 20 years ago by then-President Bob Jones III, the board of trustees and the administration began to seek to reestablish tax exemption in 2014 when Pettit assumed the office of president.

According to Chief Communications Officer Carol Keirstead, securing tax exemption was one of Pettit’s core initiatives.

“[Establishing tax exemption] was President Pettit’s priority,” Keirstead said.

“He saw the benefit of it. And somebody coming in new could grab it and run with it. And that’s what he did.”

Securing tax exemption has been a two-and-a-half-year process of consulting legal and tax experts as well as people knowledgeable about non-profit organizations.

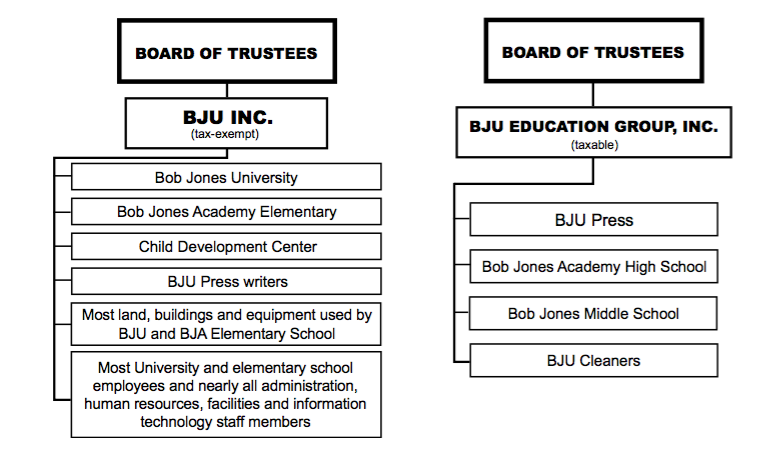

The resulting plan was to divide the BJU ministries into two individual organizations, BJU, Inc. and BJU Education Group, Inc.

BJU, Inc. will contain non-profit entities, the University and the BJA Elementary School, while BJU Education Group, Inc. will contain taxable entities, BJA High School, Middle School, BJU Press, and the BJU Dry Cleaners.

The two separate organizations have made legal agreements to allow Facilities and other departments to service both BJU, Inc. and BJU Education Group, Inc.

While BJU, Inc. will operate under the existing Board of Trustees, BJU Education Group, Inc. will be governed by a new eight-member board consisting of Pettit, two executive vice presidents and a board member as well as four external members.

Keirstead said that with the diverse interests of BJA and the BJU Press, the board needed a diversity of knowledge and experience including the business knowledge the four external members bring to the table.

Public relations director Randy Page said that although the restructuring is complicated, the effects on day-to-day life on campus will be minimal and students will probably not notice the change.

While tax exemption will allow the University to apply for some federal grants that were previously unavailable, Page said the main reason to reestablish tax exemption was to allow donors the ability to deduct their charitable donations. Keirstead and Page both believe that consequently donations to the University will increase.

“Most colleges and universities have large endowments,” Keirstead said. “We are at the disadvantage of not having built an endowment. [Pettit] knew we needed to have a better financial base to move forward. Obviously if donors can get a tax exemption, you have more donations. It’s reasonable.”

On Feb. 23, the University emailed alumni, a large portion of the University’s donor base, describing the change in tax status and the resulting change in structure. Keirstead and Page said the response has been overwhelmingly positive.

Dr. Bob Jones III, BJU president when the University lost tax exemption, expressed his personal support for regaining tax exemption.

“Unquestionably, having [tax exemption] again is going to be beneficial,” Jones said. “So I am happy about the prospect of that [benefit].”

The last three BJU presidents and the Executive Board have repeatedly reaffirmed that the former policy was wrong.

Page echoed Pettit’s sentiments from the 2017 Bible Conference.

“As a country, as a state, as an institution, we have grown. It is exciting for me to see [growth],” Page said.

“There is change, and that change is a good change. And that’s where we want to be.”