Financial choices are at every turn in the daily life of a student, and it can be difficult to think in the long term with common sense and biblical principles in mind. By using a few foundational ideas from Chris Rawlings, a faculty member in the Division of Accounting in the School of Business, and the faculty adviser for the University Investing Association (UIA), being a student and making wise financial decisions doesn’t have to be impossible.

First, the foundation for all financial thinking and decision-making needs to begin with knowing who owns the resources. “A lot of times we think ‘it’s our money; it’s our resources,’ and we give God a little bit here and there. We have to start with ‘God owns it all,’” Rawlings said.

Second, the heart of unwise decisions for some students is how they track—or don’t track—their spending. “There are some great resources available to us to manage [spending]. It’s never too early to have a budget, and there are tools like mint.com and the Mint app. It connects with your bank account, allows you to categorize your expenses, plan a budget, and track what you are spending,” Rawlings said.

Third, the time to commit to responsible decisions in finances is now. “Managing your expenses is a great lesson to learn when you’re young,” Rawlings said. Establishing habits becomes harder later in life, so it pays off to start now.

Fourth, the danger on the horizon for the average student is debt. “You have to be careful with debt—especially credit cards. The definition of investing is giving up purchasing power now to have more in the future, and the definition of debt is giving up purchasing power in the future to have more today. It’s the exact opposite,” Rawlings said.

Following through with this commitment to control debt and wait for later is always easier with a budget that is strictly set—such as a monthly spending allowance from parents. Sticking with it becomes difficult when finances become a personal responsibility, and when the decisions go beyond whether to buy a candy bar, and morph into whether to take out student loans. Remember the principle taught by Christ in Luke 16 when He said, “He that is faithful in that which is least is faithful also in much.”

Lastly, time is a resource just as valuable as money, especially in this modern age. “There is no excuse for us to not have digital calendars these day,” Rawlings said. “All resources are God’s, so we should manage [time] and budget, and track it just like we do with money.”

Remember that the resources God provides are not just spent or saved, but they can also be given. Giving to others, especially the needy, is a thought that can be exciting, not painful. “If you remember that God owns it all, giving doesn’t feel like it’s a sacrifice. His wealth is beyond what any of us can imagine,” Rawlings said.

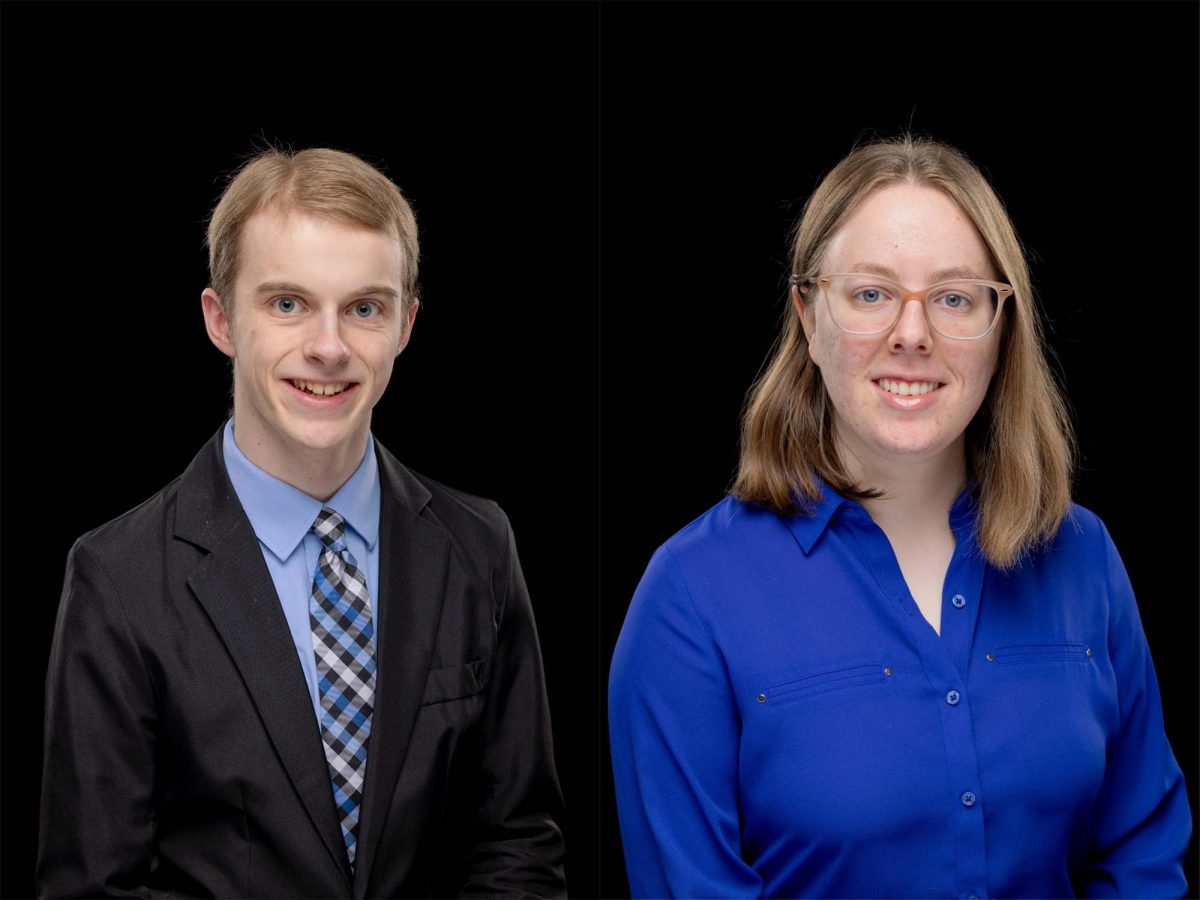

With a balance in mind between time and money, the path to success isn’t always an easy one. The University Investing Association is a resource for students who are seeking to learn how to invest wisely in complicated markets, and it is composed of more than 70 members from a variety of majors with many different career plans.

Anyone who would like more information about the UIA is welcome to contact [email protected].