“Budget.” The word itself reminds most people, particularly college students, of the disagreeable tension between paying for today’s expenses and saving for tomorrow’s goals. Thousands of books and articles have been written on the subject of money management, but it’s often hard to settle on an efficient, practical plan that actually works for you.

“Budget.” The word itself reminds most people, particularly college students, of the disagreeable tension between paying for today’s expenses and saving for tomorrow’s goals. Thousands of books and articles have been written on the subject of money management, but it’s often hard to settle on an efficient, practical plan that actually works for you.

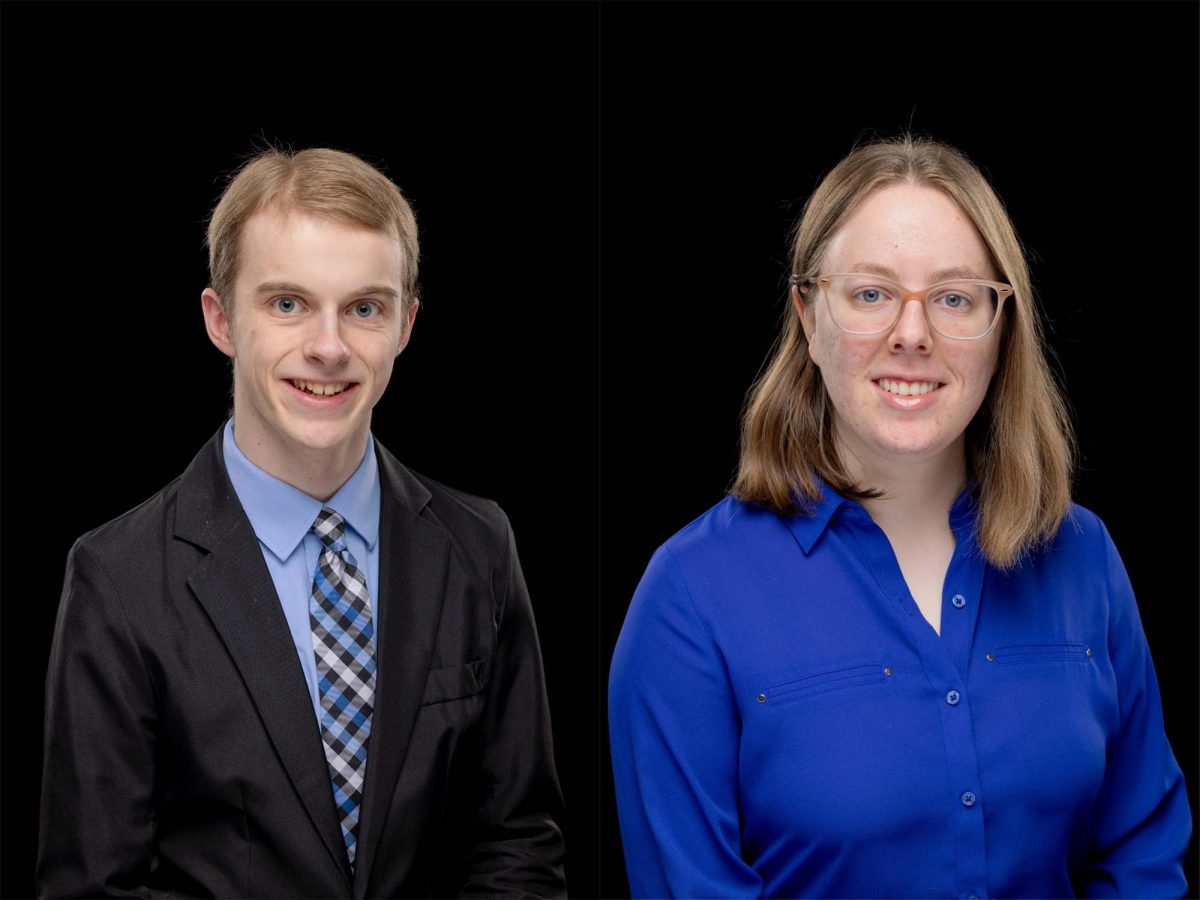

Mr. Jeff Bryson of the Division of Accounting has some practical advice for the modern college student in need of a money management plan. He offers four suggestions to manage spending and attack debt.

Consistently track your expenses.

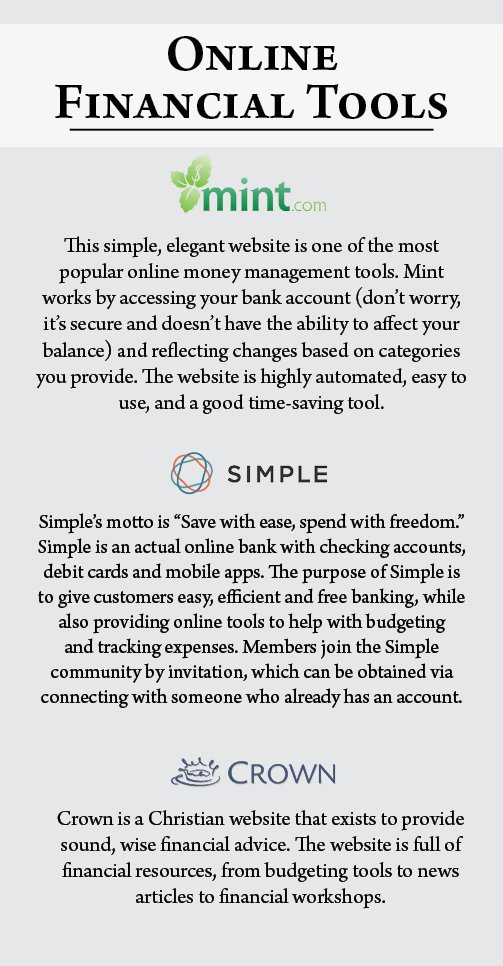

The classic notion of a regular budget is falling out of favor with many financial advisers, as many individuals end up resisting the strict categories of the budget and simply revert back to random, untracked spending. Writing down your expenses and knowing where your money is going can be much more effective than a standard budget, with its strict categories and paper tracking. “A standard budget can be useful, but with college students having such fluctuating expenses, it tends not to be practical,” senior accounting major Elisabeth Black said. “I estimate the money I have coming in and the money going out (for bills, etc.). From there I have an amount to save or spend.” Many different websites, such as mint.com and crown.org, can help you easily and efficiently track your spending, as well as save funds for the future.

Find the “leaks.”

Many people, especially in the modern world of debit and credit cards, are not fully aware of where their money is being spent. You spend $5 on a coffee here, $10 on dinner there, and you can quickly lose track of where your money is going. “For a 30-day period, track every dollar that you spend,” Bryson suggests. “The idea is to find the holes in [your] budget where money is getting away from you and you’re not remembering it.”

Stay on track, but know your limits.

While it is important and very desirable to graduate from school debt-free, make sure you have the right balance between work and school. Don’t stretch yourself too thin to pay bills that you lose sight of why you are in college in the first place. “There’s a window of time to finish college,” Bryson notes. “Just make sure you’re aware of your debt load. You probably shouldn’t have more [debt] than a year’s worth of potential salary when you graduate.”

Plan for the future.

As a college student, debt payment is crucial, but setting funds aside for the future, while also vitally important, is often forgotten. Well-known financial adviser Dave Ramsey suggests two steps for long-term preparation: create a $1,000 emergency fund and save three to six months of living expenses. Saving money for your startup expenses is another excellent strategy. “It takes more to get started in life than you realize,” Bryson said. “I would love to see a guy who has a wedding ring fund, or a young couple who is saving for their house down payment.”

Too many college students have no idea how much debt they’ve incurred or how to balance a checkbook or how to plan for future expenses. But financial security is both wise and necessary. Take control of your spending and be mindful of exactly where your money is going.